How self-regulation fails: The Boeing Case

Comment on this (at bottom of page)

Self-regulation, or “regulatory capture,” is the process whereby the government allows industry to self-certify. Self-certification may be in the form of vouching for environmental controls, vouching for engineering rigor, vouching for safety controls, etc.

There are multiple industries, from pharmaceuticals to mineral extraction, in which the government has delegated parts of the regulatory process to the industry itself. Many can see the inherent conflicts of interest and moral hazards associated with self-regulation. And it’s easier to see in some industries than others.

But there is one industry where self-regulation has worked, until now, fairly well. That industry is aviation, where both an engineering culture and an obsession with safety, work together to ensure that the manufacturers are capable of performing their own regulatory oversight.

Or at least that’s the theory. In the case of the Boeing 737 MAX, however, that process broke down and it broke down tragically.

I believe this is because of the “dual mandate” of any industry engaged in self-regulation. The first mandate is a mandate to its shareholders to husband their fiduciary interests above all else. The second mandate is, as discussed, to do the right job in ensuring safety. And the two mandates are connected — after all it’s hard to sell airplanes if word on the street is that your airplanes are unsafe.

So while it would appear that these two mandates support one another, I believe that the experience with the 737 MAX shows that one — the mandate to regulate — is subservient to the other. And that when corporate leadership determines that the first, fiduciary responsibility to the shareholders, is best served by disregarding or lessening the second, the need to self-regulate in one’s own interest, the second goes out the window.

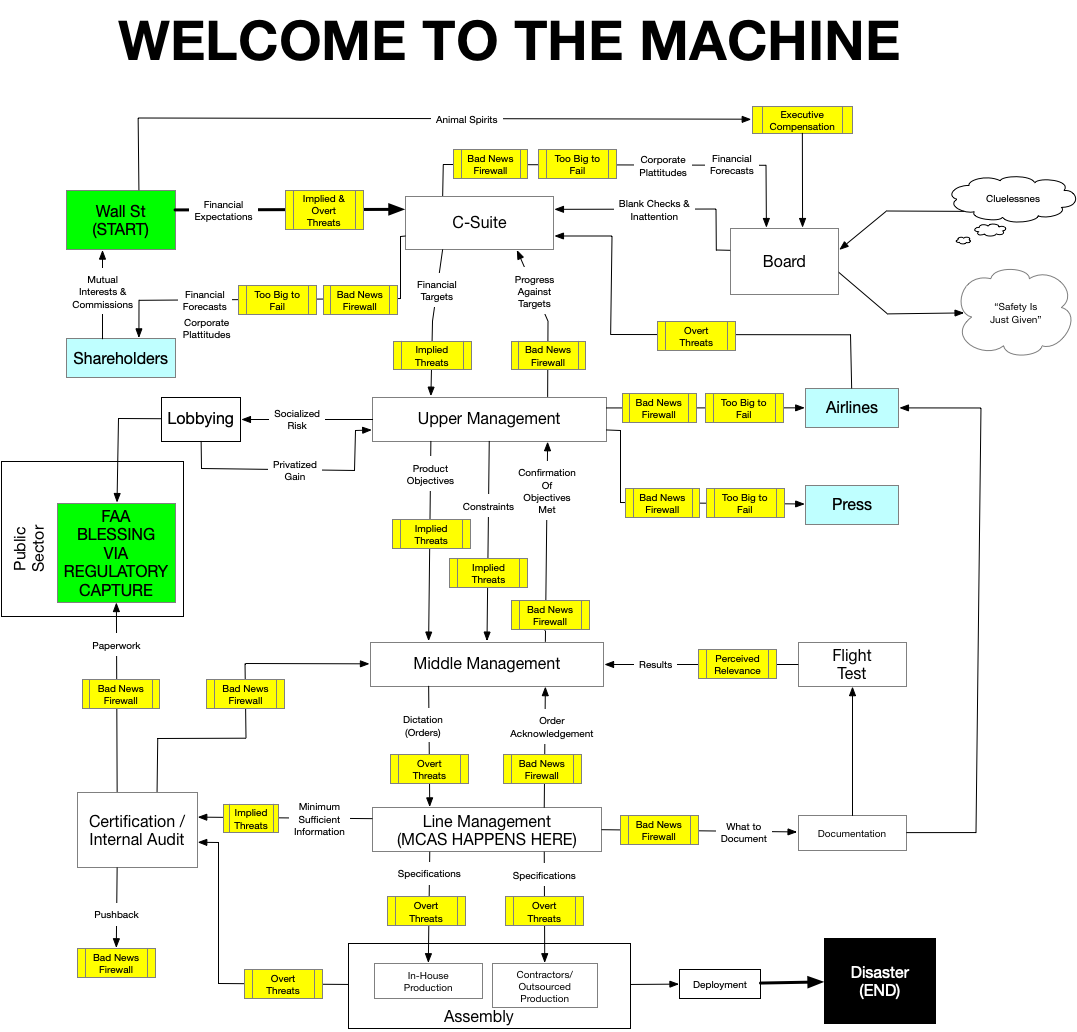

The process by which it goes out the window is not complex. A typical corporation is organized on a “command and control” model in which goals are set at the top and the means to achieve those goals are left to the rest of the organization.

In such an organization, it is possible for the goals set by the top to produce an inferior product, deficient in the self-regulation aspect, by the organization.

There are two primary mechanisms by which this happens. One is the cultural and managerial transmission of the goals from the top to the bottom. And the other is a set of “firewalls,” if you will, that prevent difficulties in achieving those goals from being heard by the top.

There is a third mechanism, a mechanism of intertia. I call this the “too big to fail” mechanism. That mechanism comes in when there is simply too much at stake — capital, reputations, goodwill, ideology — to allow any other path.

I think the diagram shows this well

There are multiple industries, from pharmaceuticals to mineral extraction, in which the government has delegated parts of the regulatory process to the industry itself. Many can see the inherent conflicts of interest and moral hazards associated with self-regulation. And it’s easier to see in some industries than others.

But there is one industry where self-regulation has worked, until now, fairly well. That industry is aviation, where both an engineering culture and an obsession with safety, work together to ensure that the manufacturers are capable of performing their own regulatory oversight.

Or at least that’s the theory. In the case of the Boeing 737 MAX, however, that process broke down and it broke down tragically.

I believe this is because of the “dual mandate” of any industry engaged in self-regulation. The first mandate is a mandate to its shareholders to husband their fiduciary interests above all else. The second mandate is, as discussed, to do the right job in ensuring safety. And the two mandates are connected — after all it’s hard to sell airplanes if word on the street is that your airplanes are unsafe.

So while it would appear that these two mandates support one another, I believe that the experience with the 737 MAX shows that one — the mandate to regulate — is subservient to the other. And that when corporate leadership determines that the first, fiduciary responsibility to the shareholders, is best served by disregarding or lessening the second, the need to self-regulate in one’s own interest, the second goes out the window.

The process by which it goes out the window is not complex. A typical corporation is organized on a “command and control” model in which goals are set at the top and the means to achieve those goals are left to the rest of the organization.

In such an organization, it is possible for the goals set by the top to produce an inferior product, deficient in the self-regulation aspect, by the organization.

There are two primary mechanisms by which this happens. One is the cultural and managerial transmission of the goals from the top to the bottom. And the other is a set of “firewalls,” if you will, that prevent difficulties in achieving those goals from being heard by the top.

There is a third mechanism, a mechanism of intertia. I call this the “too big to fail” mechanism. That mechanism comes in when there is simply too much at stake — capital, reputations, goodwill, ideology — to allow any other path.

I think the diagram shows this well